Welcome to CA community

- Special offer for practising CAs. Sign In

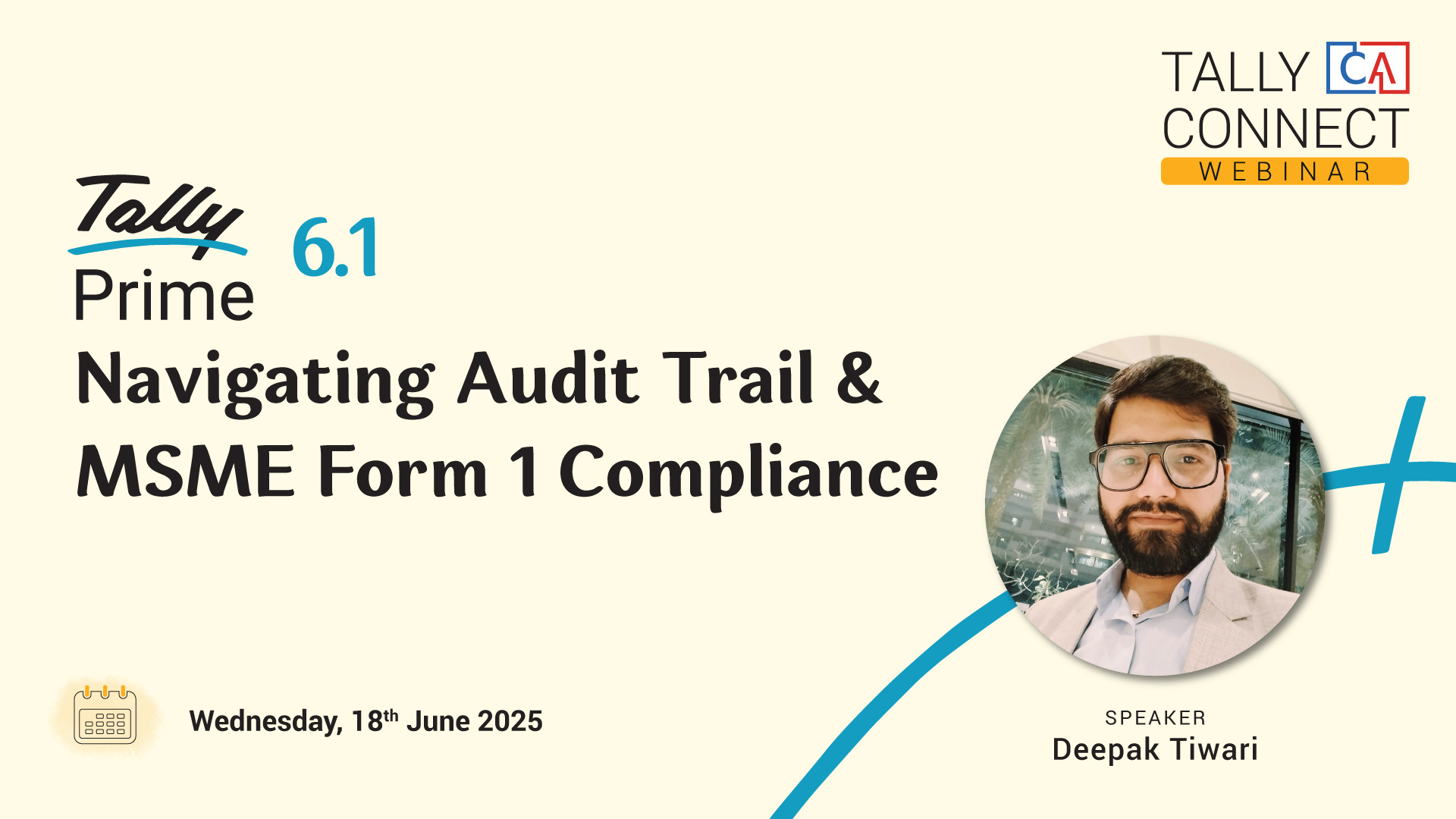

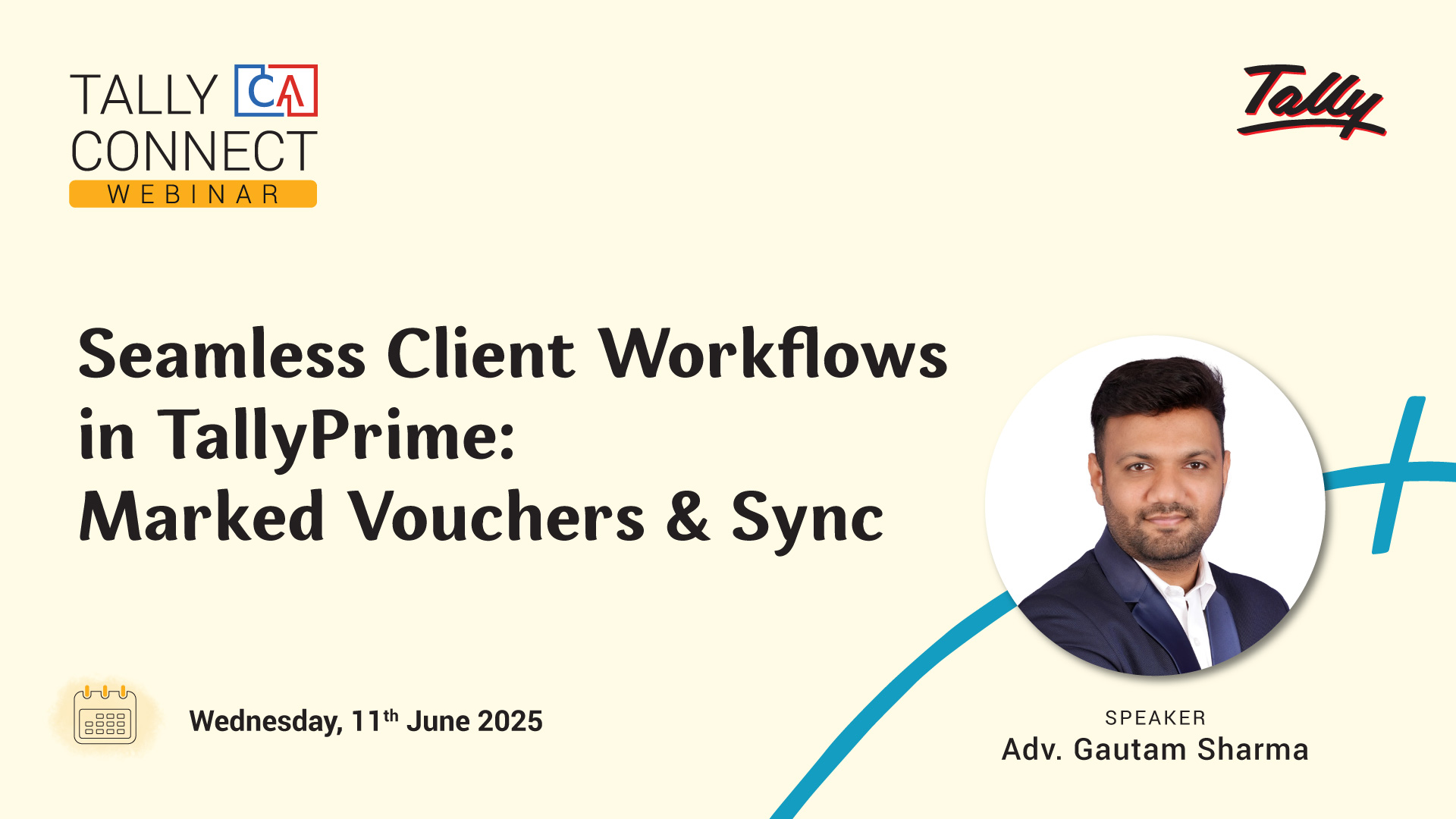

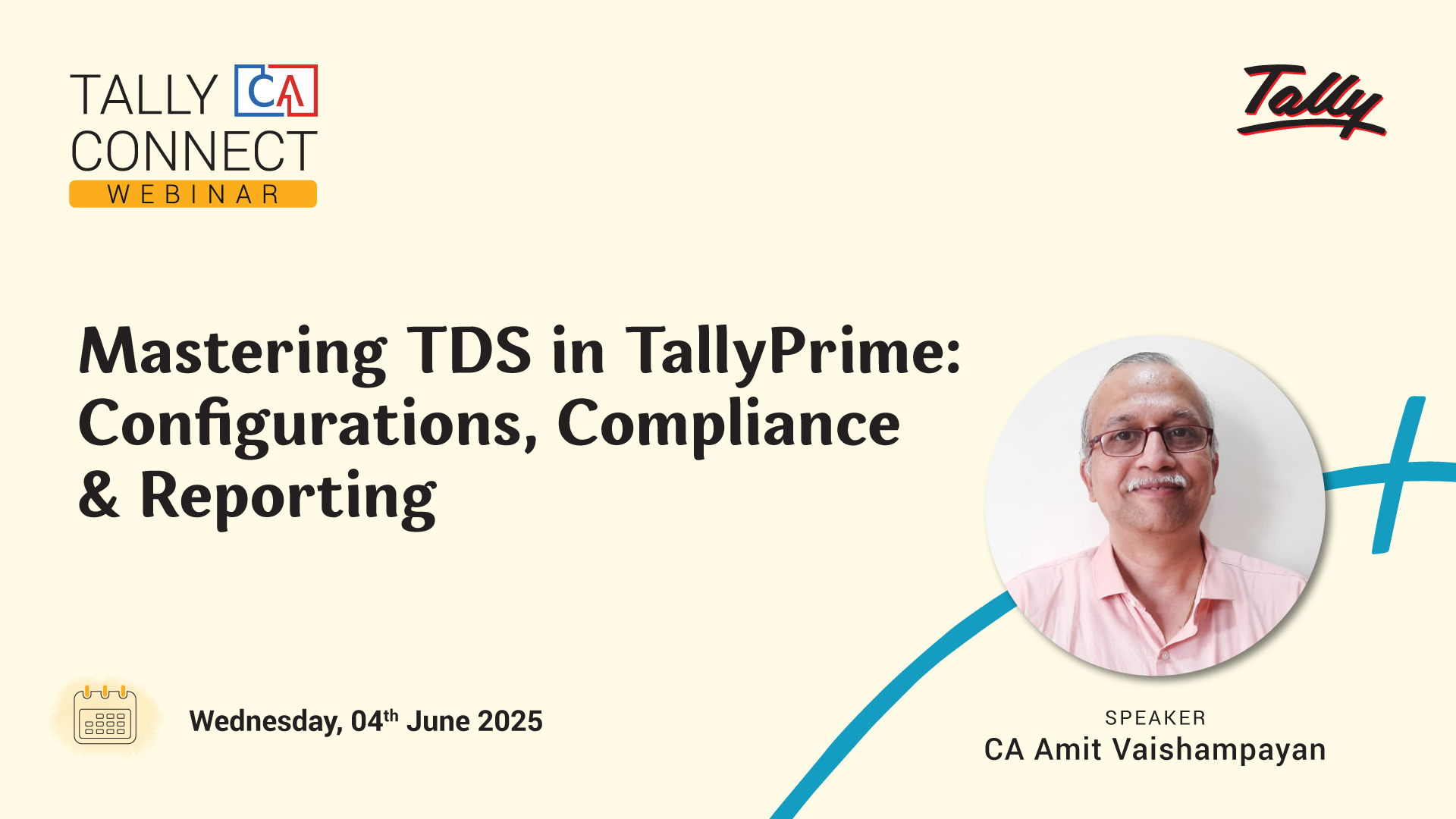

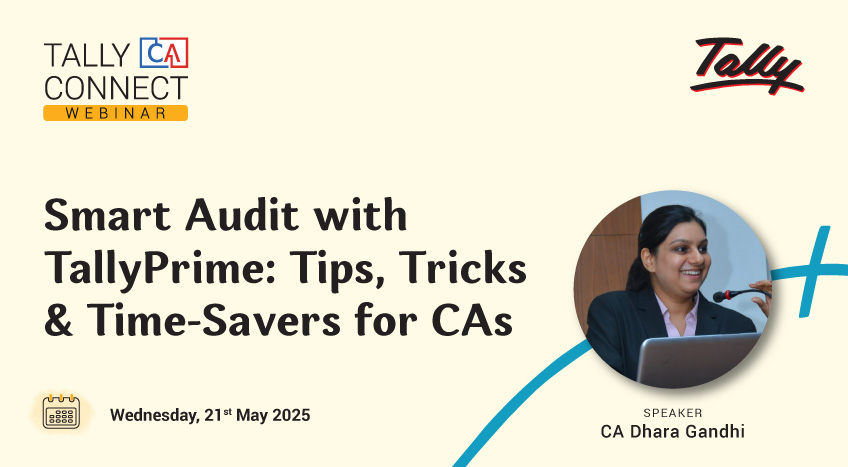

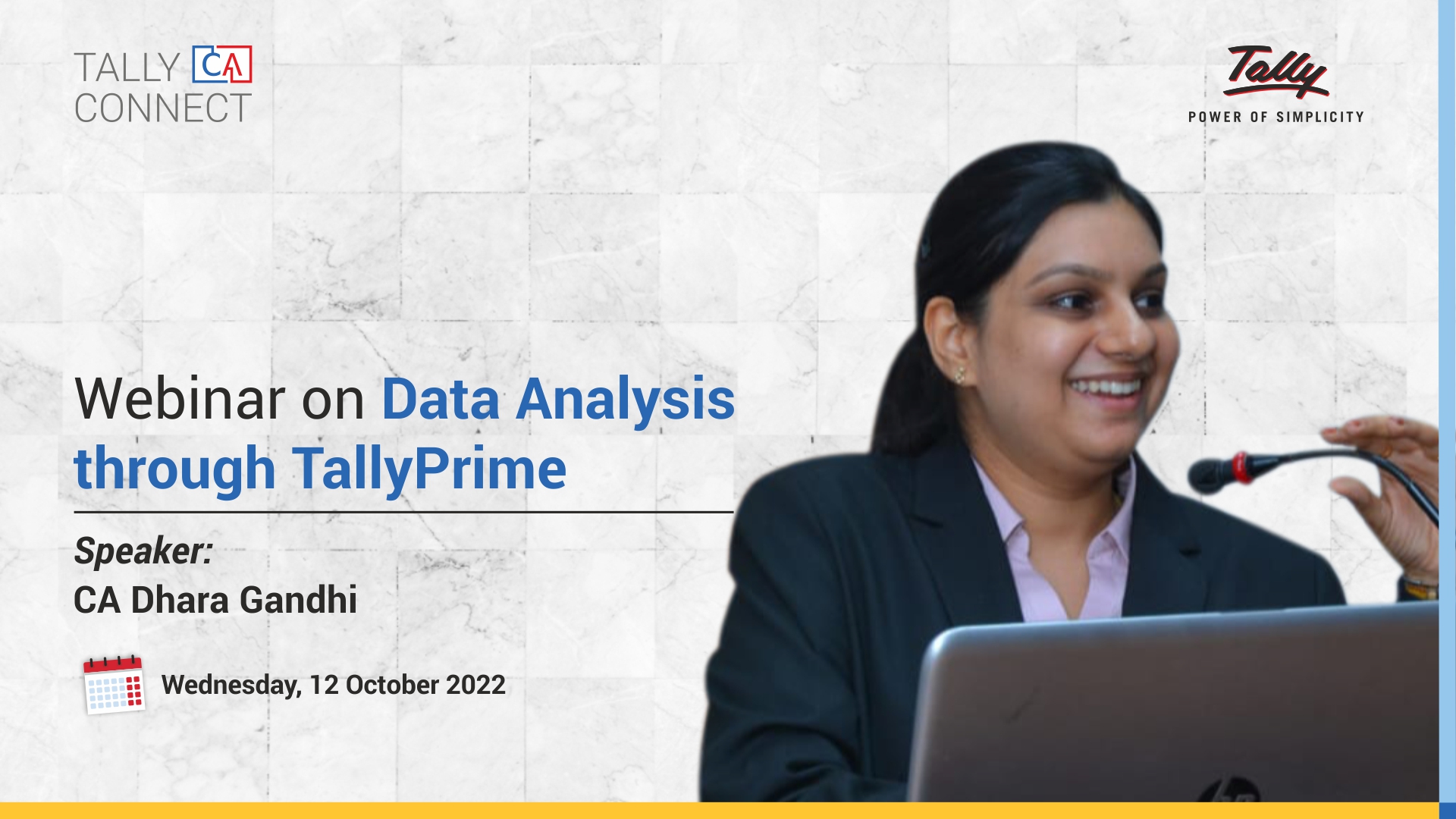

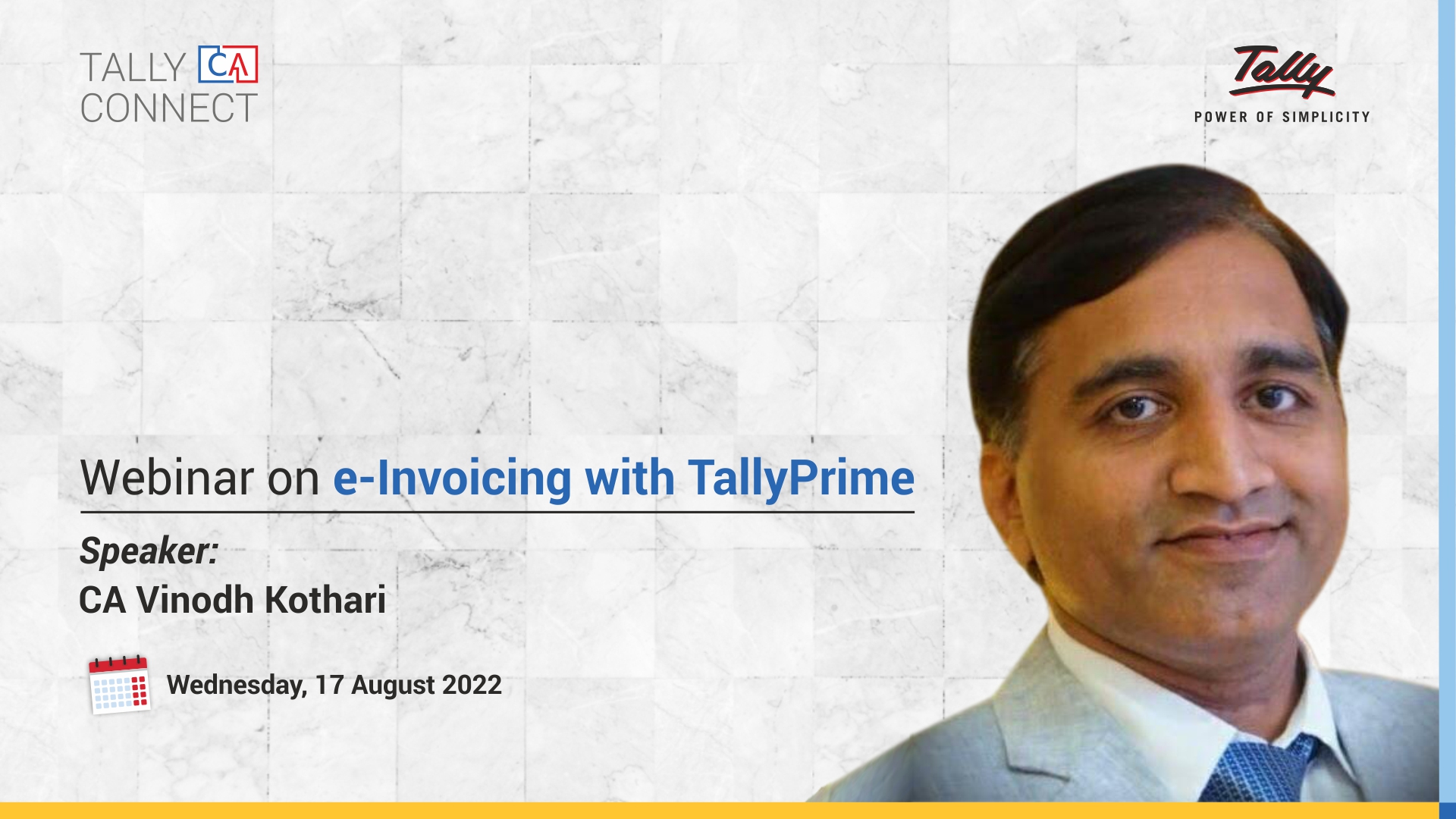

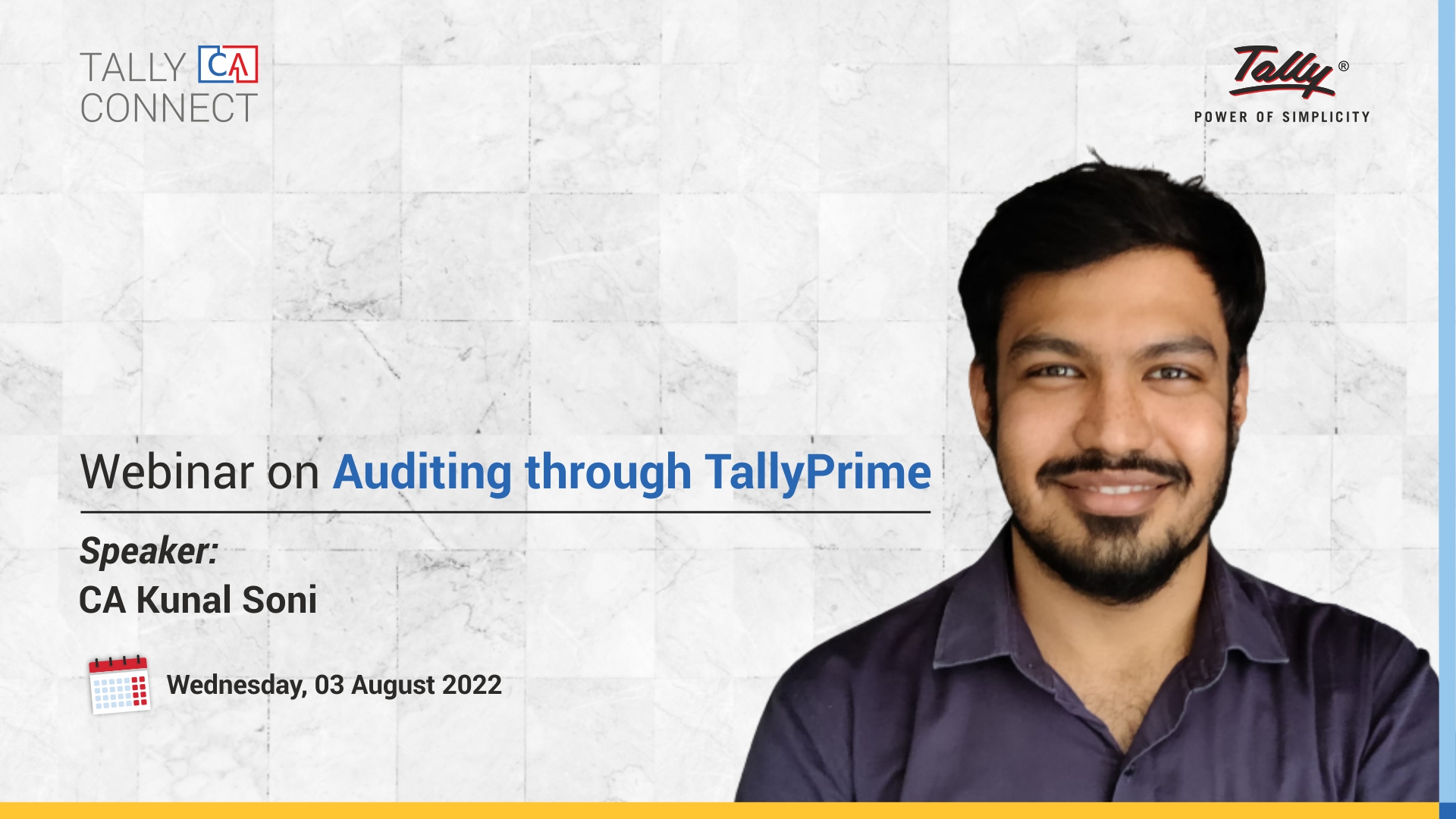

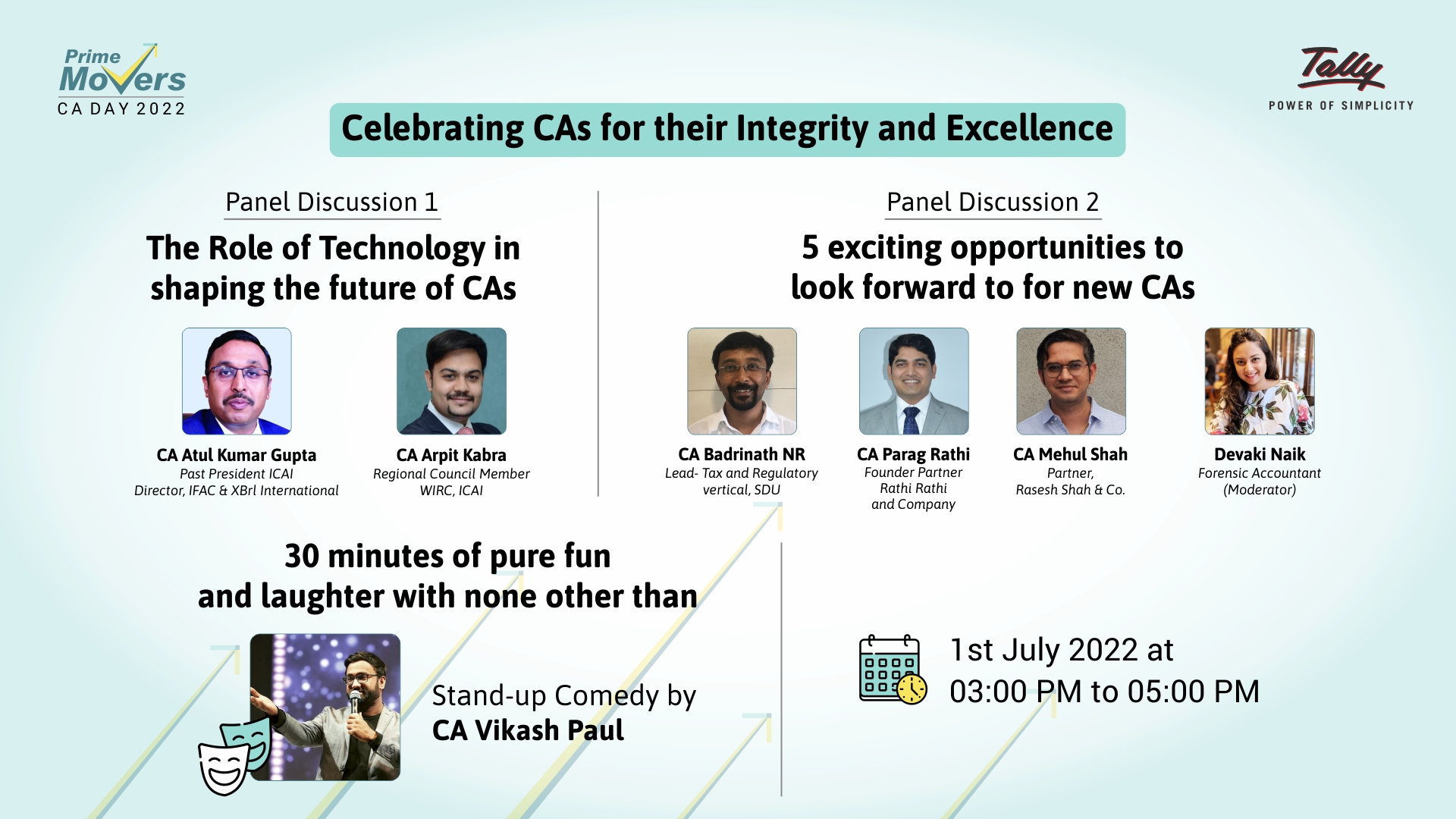

- Exclusive CA Connect webinars with Tally experts

- Stay updated with the latest on TallyPrime

- Get your queries answered by our experts

- Join the CA Community on WhatsApp

What’s new in TallyPrime

NEW

Smart Financial Statements for Non-Corporates

As per ICAI Guidance

- Invoice Management System (IMS)

- Enhanced Edit Log

- Revised MSME Form 1

- Connected Banking

- B2B-B2C HSN Summary