SHARE

| Sep-28-2021

Effective and useful features of TallyPrime 2.0 for Chartered Accountants

TallyPrime 2.0, the latest version of Tally is specially designed, for business owners empowering them to securely access actionable insights and business reports from anywhere, at any time and from any device. TallyPrime is adding up the value along with simpler and easy to use functions, more speed, power to the process, reliable and efficient work.

In TallyPrime, many features have been made for Chartered Accountants as well so that their return filing work and auditing is completed efficiently. Multi-Tasking gets easier now. The feature allows you to navigate from anywhere to everywhere easily. Also, you can get all the already opened reports without leaving out the one you were working on.

Some of the amazing features of TallyPrime 2.0 are as follows:

Easy company Login

Chartered Accountants often have to juggle between companies to check values, ledgers, etc. Once you have logged in to a company and would like to go to any other company with the same username and password, Tally remembers and recognizes you allowing you to open the company without having to waste time entering the same username password again. This saves your time and improves your efficiency.

Go to Feature

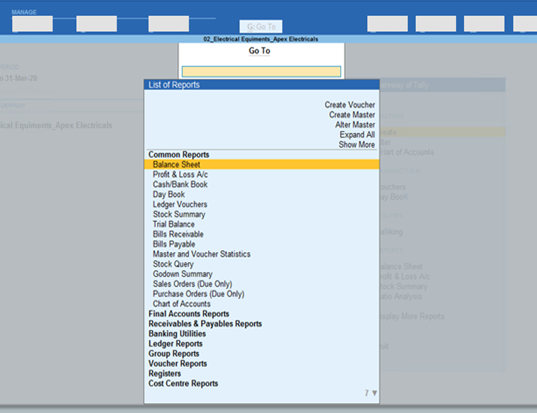

Self-Discover and seamlessly navigate through business reports by searching through Go to feature

The ‘Go To’ search bar allows you to go wherever you want in Tally without searching for it in every drop-down menu on your screen. Navigate through 90% of Tally with ‘Go To’ option. Open Outstanding details using the ‘go to’ option from any voucher screen. Put half-completed entry on hold and continue making other entries using the ‘Go To’ option. Thus you can complete multiple tasks at time in TallyPrime.

This amazing search Bar in TallyPrime allows you to switch through different screens in Tally. Use ALT + G (Go to) to multi-task in Tally

Go to Feature in TallyPrime

Multi-Tasking gets easier

Move from one report to another easily and access all the opened reports without forgetting what you were doing.

With GoTo, you will be able to handle many such situations without the hassle of switching between multiple instances of Tally or the worry of losing your progress. You can record a new voucher, create a master, view, and print reports, and get back to exactly where you left the transaction or reports

Discover the reports with the names you are familiar with

It’s quite common to refer the same report with different names. For example, bills payable and accounts payable are inter-changeably used, but it refers to the same thing.

Same goes with godown reports. You may call it has godown summary, other users may refer it as warehouse summary and another user may refer it has location summary. While the names differ, it all essentially refers to the same report.

TallyPrime understands the need and allows you to discover the report even when you search with the different terms. You can search godown summary as warehouse summary, location summary, or day book as daily entries etc. and you will still be able to discover the report that you wanted to view.

Exception report

Experience enhanced capabilities of reports by viewing any Tally report in detail.

In Chart of Accounts – ‘Group View’ - ‘Ledgers’, you get some exceptional reports like ‘Show used’, ‘show unused’. It shows you the complete list of used and unused ledgers. You can get an idea of the unused ledgers and delete this junk as it is not being used. Other than these two, there is one more important exception report - ‘Update Party GST’. This report shows the list of ledgers along with their GST details. You can fill up the GST numbers of the parties whose GST number and other details are missing in one go. go. Not just these reports, in every report, you have an option to view exception details that stand out and need your attention.

Avoid going through unnecessary fields.

While company creation or any other master/ledger creation, you can enable/disable specific fields that you think are irrelevant to you. You can turn it on anytime you want to. This will save a lot of time for data entry persons and as well as Chartered Accountants. Not just company creation, but in any information filling screen, you will always find an option to turn on/off specific fields. The best part is that even though you have disabled the specific fields, you can use ‘More details’ to mention such occasional details without disturbing the regular flow of recording translations.

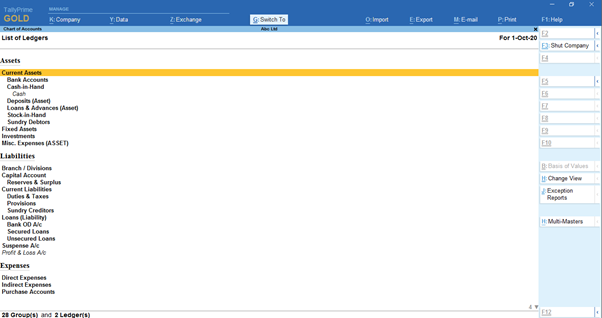

Chart of Accounts

Previously, in Tally.ERP9, ledgers were arranged in alphabetical order, but now it has been arranged as per the accounting norms, i.e. Assets, liabilities, Expenses and Income. This gives a better view for a Chartered accountant. A few new options have been added in this screen on the right-hand side panel. The ‘Change View’ option allows you to view all ledgers in one screen.

Chart of Accounts

E-way Bill and E-invoicing in Tally

E-way Bill and E-invoicing is mandatory for most businesses. To improve ease of doing business in India, Tally has an in-built E-invoice and E-way Bill generation capability in its default features. No additional cost is charged for this feature. You can get it by updating your Tally to the latest TallyPrime 2.0.

Tally is an ISO/IEC 27001:2013 certified GSP (GST Suvidha Provider). Go to the GST portal and select Tally as your GSP. Register on GST portal for E-way bill. Create an entry and if your amount exceeds 50,000rs, you will be asked if you want to generate E-way bill after saving the GST details, select Yes and enter the user Id and password. (This ID password will be saved for the next 6 hours unless you turn off your computer)

You will see a pop up saying E-way bill generated successfully. Press Enter and you will see a dialog box with three options to configure, preview and print. In this way you can create E-way bills while creating sales entry on the go

Bulk E-way bills in Tally

Click on ‘Exchange Menu’ on the top of your screen, you may generate E way bill in bulk at the day end or as and when required.

GSTIN / UIN / SAC / HSN verification

How many times have you entered a wrong GSTIN or HSN code? We all have done it atleast once. This manual error is bound to happen. Considering this a challenge for all Tally users, Tally now verifies your GSTIN and HSN code on real time basis to ensure these errors do not occur. This feature will help businesses save their ITC as well as their relations with their customers by ensuring accurate invoice filing.

‘Save as report’ Feature

You can save these report configurations by selecting the ‘Save as Report’ option on the right panel of the report screen. Click on it and name the report and next time when you open Tally you can search the name of the report and select the time period. Your report with the same configurations will open.

This feature saves a lot of time for accountants as well as business owners. It eliminates dependency for business owners.

Voucher

In Vouchers, you now have a direct option to select double-entry or single entry. This option is available inside vouchers in the ‘Change mode’. In the journal, you can make a Statutory adjustment for GSTR 3B transactions. Auto-fill is also available, which helps in filling up the TDS challans from the journal entry itself.

Tally is one of the most widely used ERP Software in Indian Business Environment. Organizations prefer using Tally due to various factors, major amongst them being the EASE of USE (Power of Simplicity – as promoted by Tally). The Core theme of Tally EASE of USE deriving from features like Codeless Masters, Flexible Data Entry, Anytime Data Modification, Merging of Data recorded in multiple Tally Instances are Advantage for Accountants and Challenge for Auditors. As a solution to this challenge, TallyPrime also added a lot of Features that are specifically relevant and useful for Auditors.

Audit tools and features in TallyPrime help in retrieving the relevant information and present them in the required form to help the Auditor form an opinion. Beyond being a good Internal Audit Tool it also facilitates the following:

Statutory Audit: It facilitates Faster Audit, various Exception Reports, General Ledger review, usage of different Sampling methods, application of Analytical procedures, Fixed Asset Analysis, Finalisation of Books of Accounts, etc. with proper Audit Visibility as well as good Documentation trail.

Tally has also made a provision, wherein you can use a license both in Tally ERP9 version as well as TallyPrime version. This will make transitioning from Tally ERP9 to TallyPrime version easier for you. Tally has been constantly updated with new features like GST compliance, e-invoicing, browser reporting and much more.

These are the key features introduced in TallyPrime 2.0. You can get your Tally updated from your service provider and start using these features to further simplify your work.

About the Author

CA Dhara Gandhi is one of the youngest and brightest minds in the field of Accountancy and is a specialist of Income Tax & GST. She has earned her name by being a popular resource person for several workshops, seminars, and webinars.

Email : cadhara.gandhi2018@gmail.com Firm : Dhara Gandhi and Associates.

Similar reads

Managing banking and accounting separately can slow you down in today’s fast-paced business world. Switching between bank portals, manually uploading statements, and reconciling transactions takes

Read More

Nowadays, business agility is essential for success in the market, rather than just being a buzzword. Businesses looking to scale, change direction, or pivot in the cloud must adapt to online

Read More

TallyPrime on AWS is a cloud accounting solution that offers businesses the flexibility to work on the same data from multiple devices and locations collaboratively. For example, imagine you are

Read More

With TallyPrime 5.0 release, we have introduced and enhanced feature: Stripe View. Let's dive into how this enhancement is set to revolutionize your data visualization experience.

Read More

TallyPrime 5.0 connected GST return filing experience will prove to be a game-changer for businesses. With seamless uploads, downloads, auto-reconciliations, and return filing, TallyPrime has now tran

Read More