SHARE

| Apr-28-2021

RoDTEP Scheme

Remission of Duties and Taxes on Exported Products Scheme

RoDTEP Scheme, as the name Suggests, it provides Remission of Duties and Taxes on Exported Products, for which at present, the Taxes are not Refunded by the Government in any manner.

Why This Scheme

It is very important to understand that, why this scheme was Introduced? There are many government incentives like, MEIS, EOU/EHTP/BTP, EPCG Scheme, SEZ, DFIS (Duty Free Import Scheme). All of the mentioned Schemes more or less were, Contradicting SCM Agreement {Subsidies and Countervailing Measures Agreement} in WTO and were against the Trade Norms. Reason being all this were Incentives, rather than Reimbursement of Taxes. Thus, US Challenged the India’s Exports Incentives in March 2018, and in October 2019 WTO ordered India to withdraw its Export Incentives.

Effective Date of Implementation

On 13th March 2020, The Cabinet Committee on Economic Affairs, has given its approval for introducing the Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP) under which a mechanism would be created for reimbursement of taxes/ duties/levies, at the central, state and local level, which are currently not being refunded under any other mechanism. On 31st December,2020, Ministry of Finance came up with Press Information Bureau that RoDTEP gets implemented from 01.01.2021.

Salient Features

- Scheme to Boost Exports, for enhancing Exports to International Markets.

- To make Indian exports cost competitive.

- Is WTO Compliant.

- Will give Boost to Employment Generation in Various Sectors.

- In line with “Digital India”, refund under the Scheme, in the form of transferable duty credit/electronic scrip will be issued to the exporters, which will be maintained in an electronic ledger. The Scheme will be implemented with end-to-end digitization.

- A monitoring and audit mechanism, with an Information Technology based Risk Management System (RMS), would be put in, to physically verify the records of the exporters.

- An exporter desirous of availing the benefit of the RoDTEP scheme shall be required to declare his intention for each export item in the shipping bill or bill of export.

- Scrip generation provision will be made functional on the issuance corresponding notification by the department and availability of the budget.

RoDTEP Incentives

- Will reimburse taxes/duties/levies at the central, state and local level, which are currently not being refunded.

- The refunds under the RoDTEP scheme would be, along with refunds such as Drawback and IGST.

- At present, GST taxes and import/customs duties for inputs required to manufacture exported products are either exempted or refunded. However, certain taxes/duties/levies are outside GST, and are not refunded for exports, such as, VAT on fuel used in transportation, Mandi tax, Duty on electricity used during manufacturing etc. These would be covered for reimbursement under the RoDTEP Scheme.

- The rebate would be claimed as a percentage of the Freight on Board (FOB) value of exports.

- The RoDTEP shall be allowed, subject to specified conditions and exclusions. The notified rates, irrespective of the date of notification, shall apply with effect from 1 January, 2021 to all eligible exports of goods.

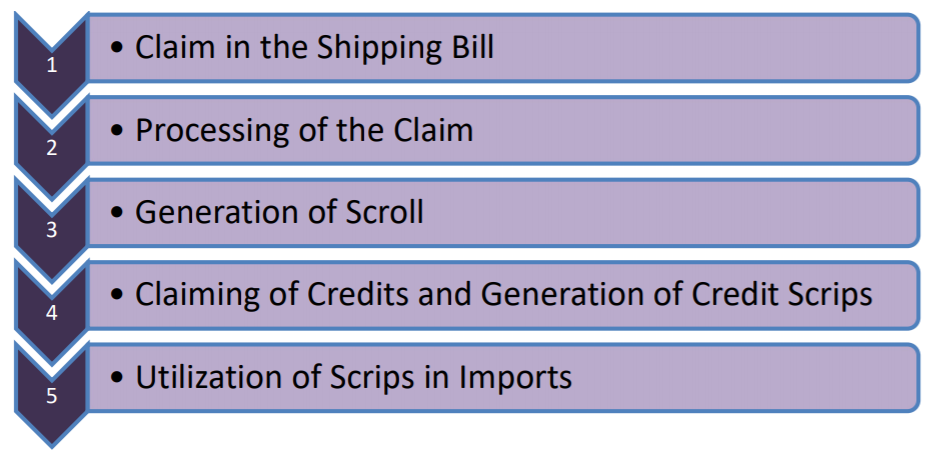

Procedural Aspect

- To avail the scheme exporter shall make a claim for RoDTEP in the shipping bill by making a declaration.

- Once EGM is filed, claim will be processed by Customs.

- Once processed a scroll with all individual Shipping Bills for admissible amount would be generated and made available in the users account at ICEGATE,

- User can create RoDTEP credit ledger account under Credit Ledger tab. This can be done by IECs who have registered on ICEGATE with a DSC.

- Exporter can log in into his account and generate scrip after selecting the relevant shipping bills.

Process Flow

Matters to be taken care

- W.e.f. 01.01.2021, it is mandatory for the exporters to indicate in their Shipping Bill whether or not they intend to claim RoDTEP on the export items. This claim is mandatory for the items (RITC codes) notified under the new scheme. Since the final list of RITC codes eligible for RoDTEP scheme and the corresponding rates are yet to be notified by the Government, this declaration has been made mandatory for all items in the Shipping Bill starting 01.01.2021.

- It may be noted that if RODTEPY is not specifically claimed in the Shipping Bill, no RoDTEP would accrue to the exporter. Once the rates are notified, System would automatically calculate the RoDTEP amounts for all the items where RODTEPY was claimed. No changes in the claim will be allowed after the filing of the EGM.

- There are some checks built in the System to disallow RoDTEP benefit where the benefit of certain other schemes like Advance Authorization, EOU, Jobbing etc. has been availed.

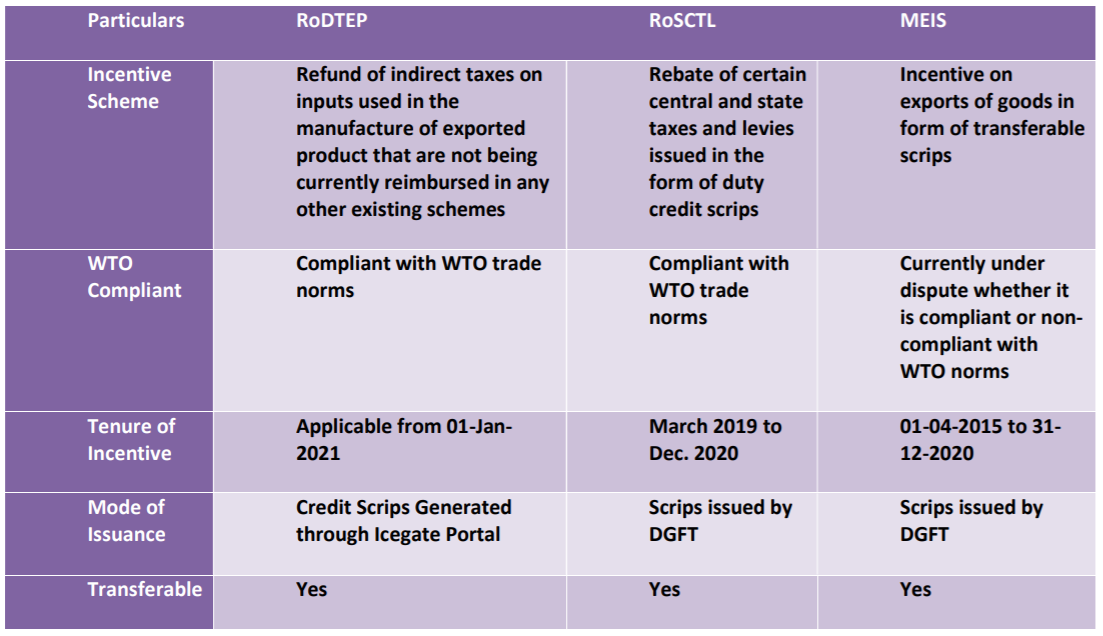

Comparison RoDTEP, RoSCTL,MEIS

Matters requiring Clarification:

Here major thing is as on date government has not yet came up with the rates under RoDTEP Scheme, thus exporters are still not aware as to the availability of Actual benefit available under the RoDTEP Scheme. Further for Exporters who are exporting against Advance License they are not able to yet decide Whether going for Advance Authorization License is more Beneficial or Going for RoDTEP Scheme is more beneficial. This would only be clarified upon Notification of Rate by the Government.

About the Author

CA Kunal Soni, is a practicing Chartered Accountant and Associate at Mistry and Shah LLP. He specialises in System Implementation for corporates and provides advisory on corporate finance structuring and various incentive schemes.

Contact Number : 8000845035

E mail Id : k.soni@mistryandshah.com

Website : www.mistryandshah.com

Similar reads

CHANGES IN CUSTOMS The Finance Minister introduced the Finance (No.2) Bill, 2024 in Lok Sabha today, 23rd July 2024. Changes in Customs, Central Excise and rates have been proposed through the Financ

Read More

The CESTAT, New Delhi in the matter of M/s BBM Impex Pvt. Limited v. Principal Commissioner of Customs (Preventive) [Customs Early Hearing Application No.50414 of 2022 with Customs Appeal No. 51662 of

Read More

The CESTAT, New Delhi in the matter of M/s Prem Kumar Ojha v. Commissioner of Customs-Jaipur I [Customs Miscellaneous Application No. 50245 of 2022 dated July 04, 2022] held that, in view

Read More

The CESTAT, New Delhi in the matter of M/s Shri Shyam Ingot & Castings Pvt. Ltd. v. Commissioner of Customs & Central Excise [Excise Appeal No. 52550 of 2019-SM dated August 08, 2022] held

Read More

The CESTAT, Chennai in the matter of M/s. SK Enterprises v The Commissioner of Customs [CUSTOMS APPEAL No. 40017 of 2022 dated June 24, 2022] set aside and held that the revaluation of the goods

Read More