SHARE

| Feb-20-2024

Highlights of Interim Budget 2024-25 regarding GST

The Hon’ble Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, while presenting the Interim Budget 2024-25 in Parliament today asserted that by unifying the highly fragmented indirect tax regime in India, GST has reduced the compliance burden on trade and industry.

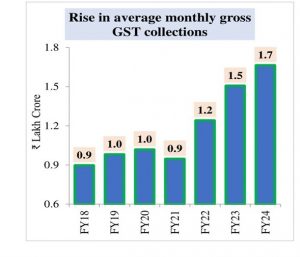

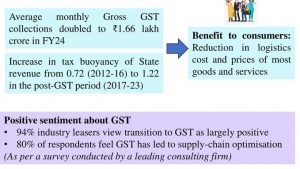

“According to a recent survey conducted by a leading consulting firm, 94 per cent of industry leaders view the transition to GST as largely positive and according to 80 per cent of the respondents, it has led to supply chain optimization” she said. Smt. Sitharaman further added that at the same time, tax base of GST more than doubled and the average monthly gross GST collection has almost doubled to ₹ 1.66 lakh crore this year.

Talking about the increased revenue of states, the Finance Minister said that States, SGST Revenue, including compensation released to states, in the post-GST period of 2017-18 to 2022-23, has achieved a buoyancy of

1.22. In contrast, the tax buoyancy of State revenues from subsumed taxes in the pre-GST four-year period of 2012-13 to 2015-16 was a mere 0.72. The Union Finance Minister asserted that the biggest beneficiaries are the consumers, as reduction in logistic costs and taxes have brought down prices of most goods and services.

Key highlights of GST

- FM proposes to retain same tax rates for indirect taxes and import duties

- GST unified the highly fragmented indirect tax regime in India. Average monthly gross GST collection doubled to Rs 1.66 lakh crore this year

- GST tax base has doubled

- State SGST revenue buoyancy (including compensation released to states) increased to 1.22 in post-GST period(2017-18 to 2022-23) from 0.72 in the pre-GST period (2012-13 to 2015-16)

- 94% of industry leaders view transition to GST as largely positive GST led to supply chain optimization

- GST reduced the compliance burden on trade and industry

- Lower logistics cost and taxes helped reduce prices of goods and services, benefiting the consumers.

Some key features of the Budget 2024-25 related to GST are:

Similar reads

Managing business finances isn’t just about bookkeeping—it also involves handling payments, tracking cash flow, and ensuring accurate reconciliation. While accounting has become more automated

Read More

The latest release of TallyPrime brings a suite of features that significantly simplify GST and reporting tasks. From creating ledgers with a click to tracking every GST-related activity, these

Read More

Direct Tax India is growing at an accelerated pace and people are undertaking multiple financial transactions. The Income Tax Department has established a robust framework of reporting of taxpayers'

Read More

The Finance (No.2) Bill, 2024 has proposed changes in the CGST Act, IGST Act, UTGST Act and GST (Compensation to States) Act, 2017 through Clauses 110 to 146 of the Bill in CGST Act 2017, through.....

Read More

The Goods and Services Tax Network (GSTN) ushers in a transformative update to the GSTR-1 return, unveiling two pivotal tables – Table 14 and Table 15.

Read More