SHARE

| Aug-06-2021

How to Pass Sales Entry in TallyPrime for Sales Done Through E Commerce Operators Like Flipkart, Amazon etc.

A lot of business organizations sell their products through online portals. In such scenarios, the Sales invoice is generated directly from the Website of the E Commerce Operator and issued to customer. The Portal of the E Commerce Operator is pre-set with the required settings as regards to the HSN of the product sold, the tax rate and the chargeability of GST, based on the place of supply of the product. there can be a situation when the end customer, the E Commerce Portal and the Client belong to different states.

As a rule, the sales transaction passed in Tally should hit the B2B and B2C list of GST 1, based on the GST registration type of the end customer and not the E Commerce Portal.

Also supplies made to unregistered person(s) outside the state should flow to the relevant column 3.2 of GST 3B.

The scheme of entries to be passed is explained as under :

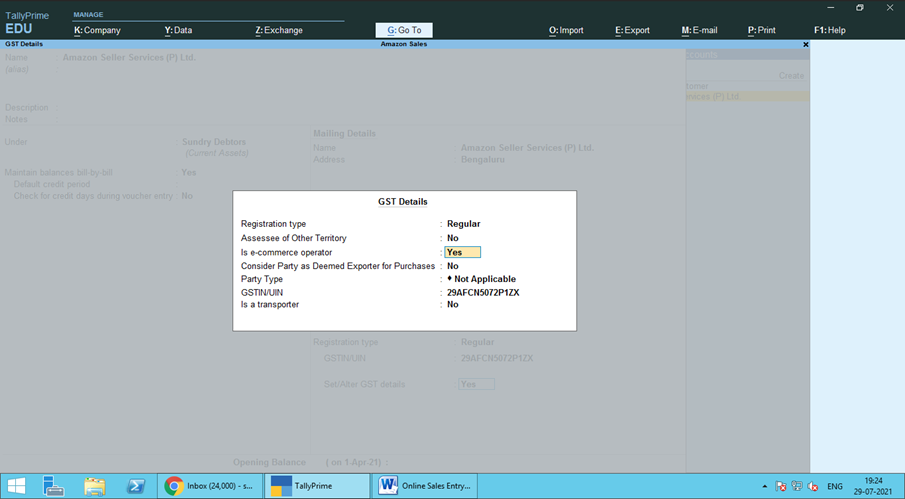

Settings to be done in E Commerce Operator Ledger – GST Details

Is E Commerce Operator - YES

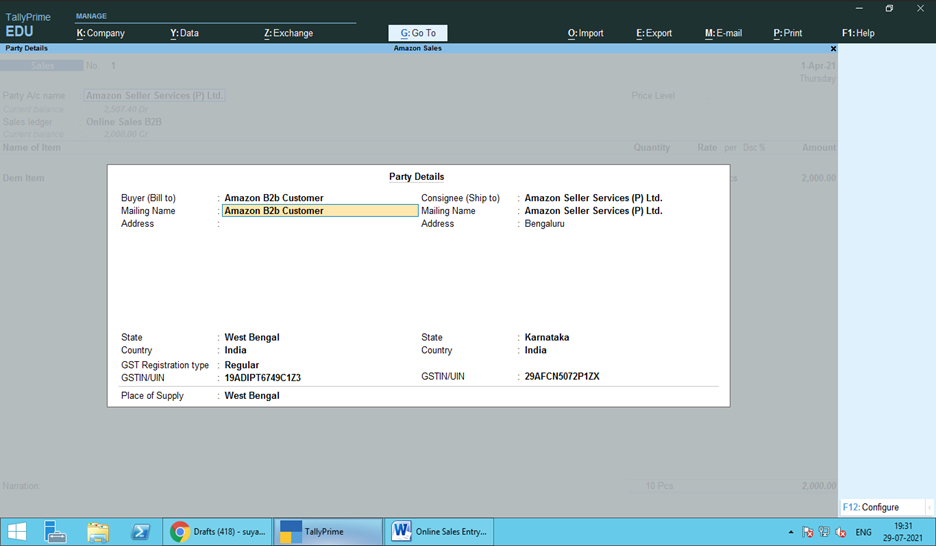

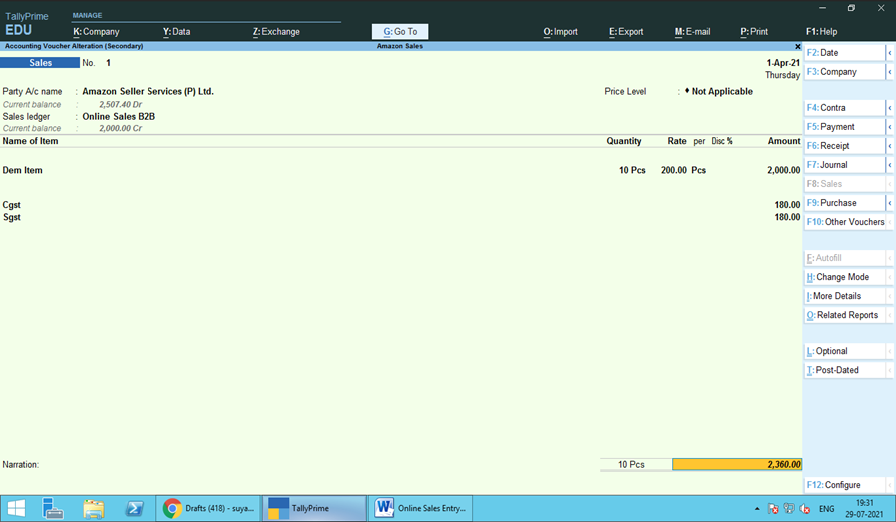

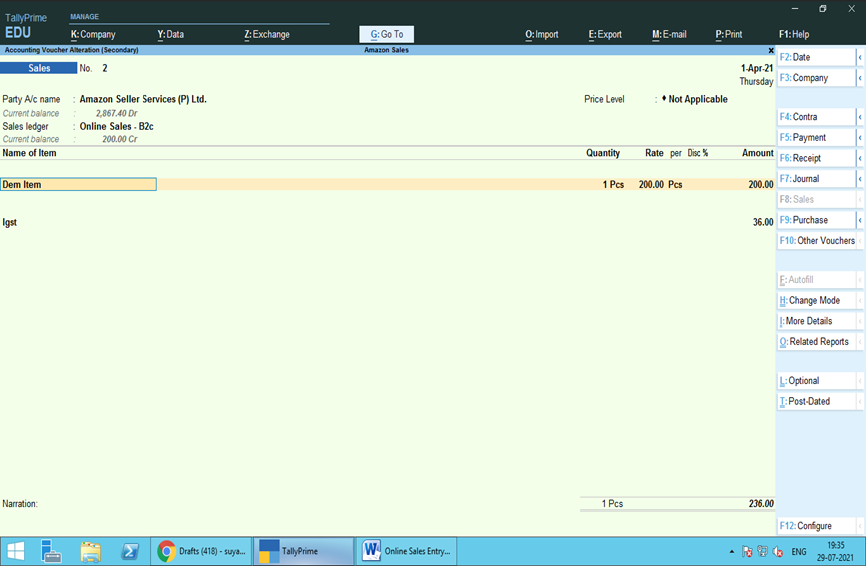

Sales Entry for B2B Sales - Buyer and Consignee Details Screen

End Customer Place of Supply is West Bengal – Hence CGST and SGST will be charged

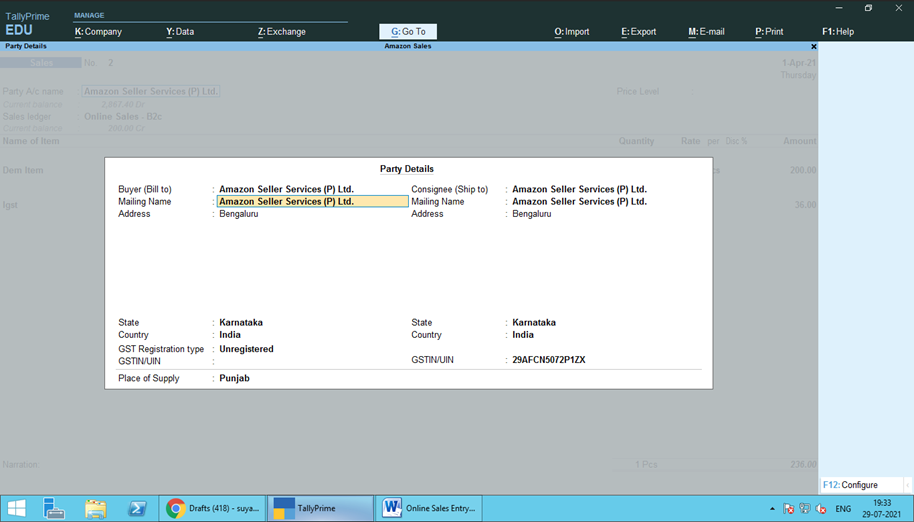

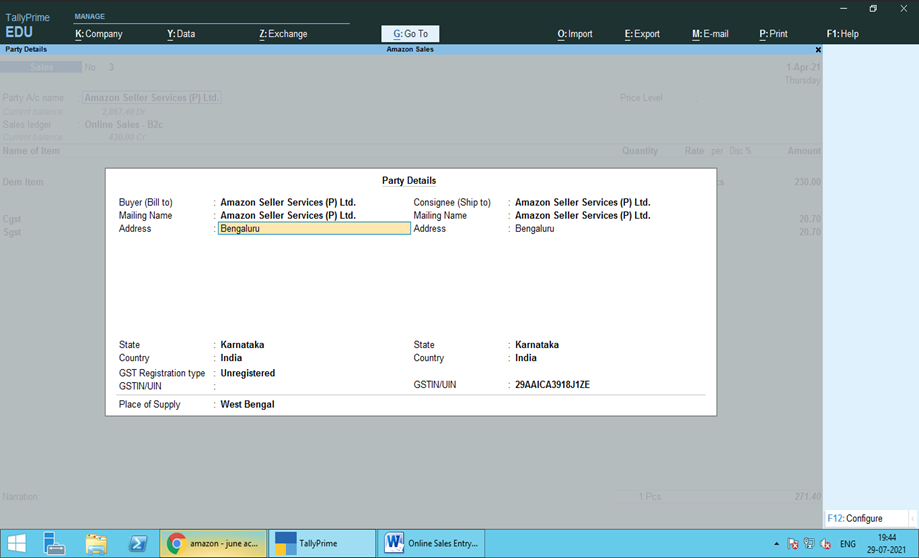

Online B2C Sales Entry – Buyer Consignee Details Screen

GST Registration Type mentioned as ‘Unregistered’. Place of Supply provided for End Customer.

Place of Supply is Punjab, hence IGST is Charged

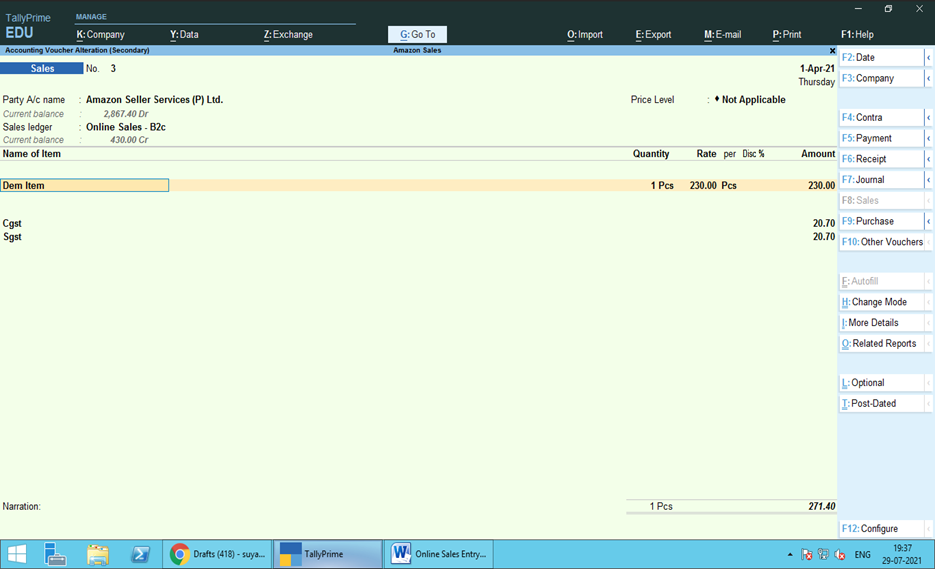

Another B2C Sales to customer located in West Bengal. CGST and SGST is Charged

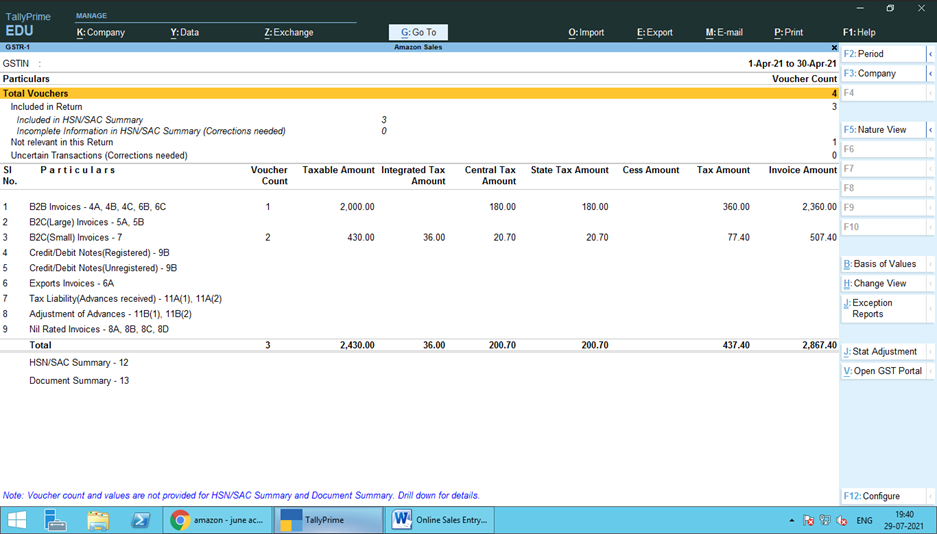

GST -1 Generated from Tally.

1 Invoice appearing in B2B and 2 Invoice appearing in B2C Sales

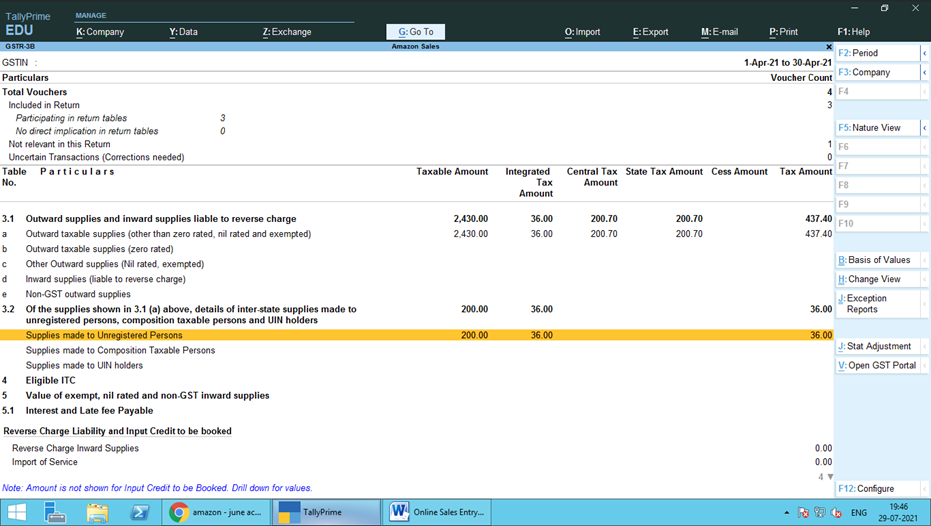

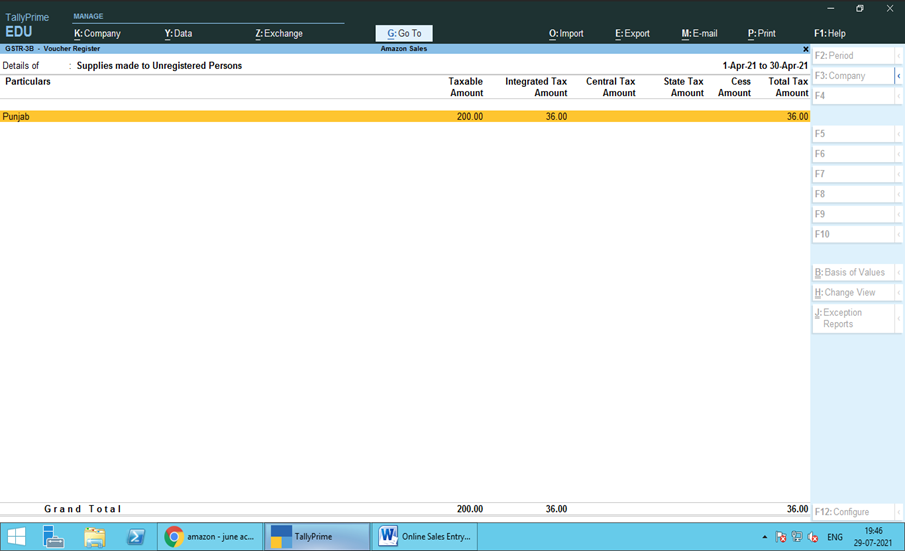

GST 3B from Tally

Sales made to unregistered persons outside the sate appearing in Table 3.2

About the author

CA Suyash Tulsyan

Email :suyashtulsyan@gmail.com

Similar reads

Managing banking and accounting separately can slow you down in today’s fast-paced business world. Switching between bank portals, manually uploading statements, and reconciling transactions takes

Read More

Nowadays, business agility is essential for success in the market, rather than just being a buzzword. Businesses looking to scale, change direction, or pivot in the cloud must adapt to online

Read More

TallyPrime on AWS is a cloud accounting solution that offers businesses the flexibility to work on the same data from multiple devices and locations collaboratively. For example, imagine you are

Read More

With TallyPrime 5.0 release, we have introduced and enhanced feature: Stripe View. Let's dive into how this enhancement is set to revolutionize your data visualization experience.

Read More

TallyPrime 5.0 connected GST return filing experience will prove to be a game-changer for businesses. With seamless uploads, downloads, auto-reconciliations, and return filing, TallyPrime has now tran

Read More