SHARE

| Jun-08-2021

Safeguards for Smooth Generation of E-invoice From TallyPrime

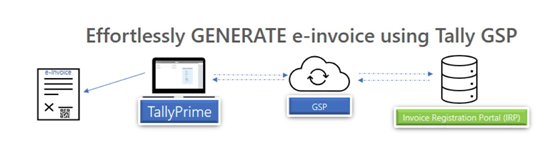

In its commitment to bring transparency and digitization in the entire nation, Government has published norms for generating E-invoice i.e. In simple terms Invoice whose details are authenticated by the GSTN is called E-invoice.

In E-invoicing all B2B Invoices, generated by specified suppliers, needs to be registered with the government portal i.e. Invoice Registration Portal (IRP). After Authentication the IRP shall issue a 64-digit unique IRN (Invoice Reference No) which has to be converted in QR Code. For a valid E-invoice, QR code needs to be printed on the face of the invoice.

As can be seen from above, the process involves sharing of critical data with government on near live basis. Moreover, the same information is used by multiple agencies like E-waybill, Income Tax Authorities, Auditors etc. It is also pertinent to note that the Government is relying more and more on data analytics to identify the defaulters or misusers of the system. Any cancellation / mismatch with actuals can involve legal challenges in future.

Process Flow

How to Generate E-invoice

The detailed process of generating E-invoice is available in the following links:-

https://help.tallysolutions.com/tally-prime/gst-regular-sales/e-invoicing-in-tallyprime/

This article is an attempt to provide a shield of knowledge on common errors that users make while generating the E-invoice and help avoid them.

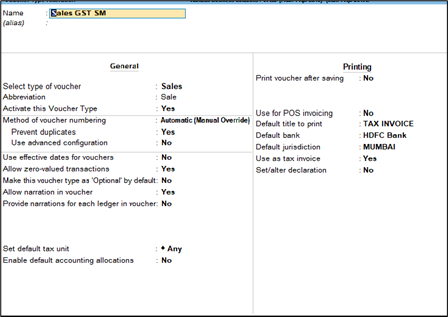

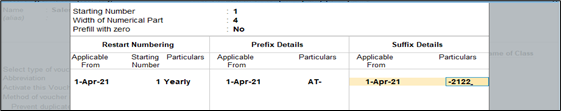

The numbering requirements for Tax Invoice are stringent, while most common of them is that the Invoice number should not be more than 16. There are more configurations that have to be taken care of:

- Firstly, if the type of numbering is Automatic than there is always a chance that the number might get shifted due to any new voucher created, deleted or inserted in between existing vouchers. Instead, One should prefer the method of numbering to Automatic (Manual Override)

This method ensures two things: a) User gets benefit of Auto numbering (i.e. New number is added based on last saved voucher number and b) Even if there is deletion or creation of any voucher in the already saved series the number do not get shifted.

- The number should not start with Zero

- Special Character like “$\ _@” should also be avoided in the number series, Further “space” should also not be there in between the number. The only characters allowed are forward slash “/”&dash “-“.

IRP portal generates the IRN number based on the voucher number at the time of generating E-invoice. Any change in numbering thereafter would create problem in reconciling with GSTR1 and Tally would also show error in mismatch in QR Code.

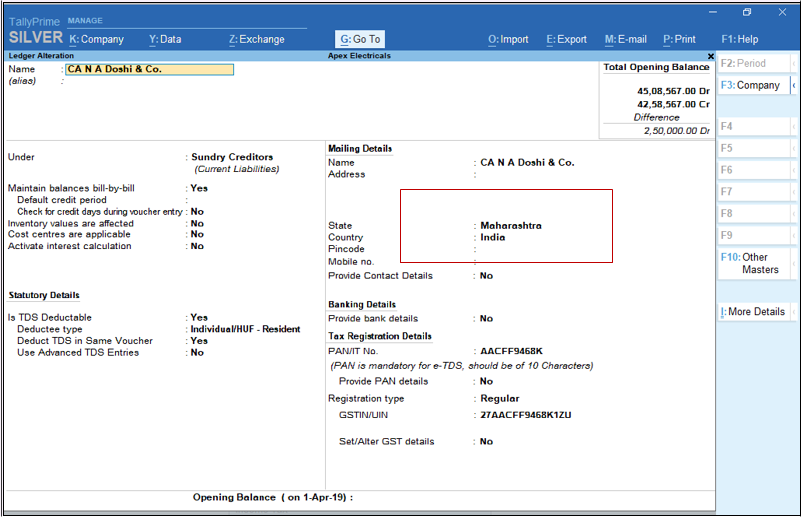

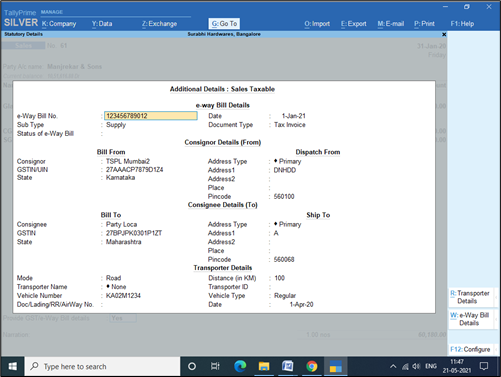

Safeguard-2 Selection of State and updation of Pin code

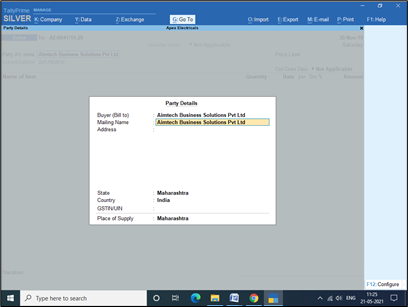

TallyPrime allows selection of state in which goods have been sold at multiple levels, users should ensure that state information is updated at various levels. Pincode must be 6 digit without space i.e.400034

- Masters

- Transaction Level

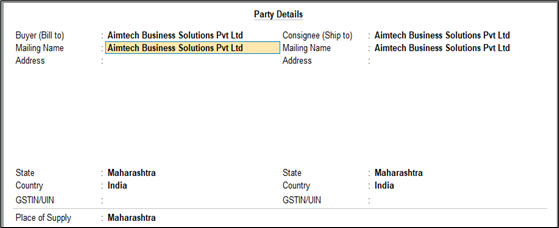

- Buyer State

- Consignee state

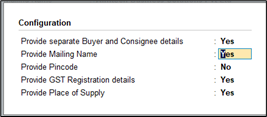

By Clicking F12 on above screen: Allow Separate Buyer and Consignee Details

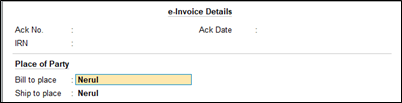

- Bill to Place to be update In Einvoice details screen above transaction

- For Eway bill compliance

- Buyer State

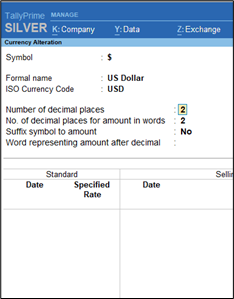

Safeguard-3 Update the Currency Masters for Export Transactions

While generating E-invoice for Export sales, when the invoice is in foreign currency, Updating of ISO Currency Code as below

Go to Currency >> Alter >> Select the currency >> Update the ISO Code.

Safeguard-4 :-Cancellation of E-invoice

There may be situations where the IRN is generated for a particular voucher, but you might have to cancel it. As per GSTN department, invoice cancellation has to be done within 24 hours of IRN generation. One must first select Cancel IRN and then Update Cancellation and then confirm the reason for cancellation >> Connect with GSTN >>Cancel the IRN on the Portal >> In Tally Also Cancel the Einvoice by Clicking Alt+X. The detailed process for cancelling einvoice is referred here https://tallysolutions.com/gst/how-to-cancel-e-invoice-in-gst/ .

Some users follow marking for cancellation, without going through the next steps and this can create problems such as mismatch of accounting data with IRP data, Further, GSTR1 is auto-populated from the e-invoice information and thus total sales would be inflated for that month.

So, what if 24 Hours are over, can E-invoice not be cancelled?

In such situation it is better to raise a credit note for the sales invoice generated and New Invoice should be generated for the transaction. One must ensure that the NEW invoice number is not the same as old number.

Safeguard-5: HSN / SAC Code

During the process of E-invoice, information on HSN Code is flowing from the books of accounts to the GSTN Portal. In TallyPrime users can provide for HSN codes at multiple levels i.e. Ledger, Group, Item, etc. In case of conflict by which users have mentioned different HSN Codes at different level then there is an inherent hierarchy by which the TallyPrime sends the HSN Code data to the Portal.

Currently the hierarchy is as mentioned below:

- Transaction

- Ledger Master

- Accounts Group Master

- Stock Item Master

- Stock Group Master

- Company Level.

Thus, if the HSN information is provided at the 1st Level i.e. Transaction, then any conflicting information below would not be considered while posting the E-invoice.

How to provide for Multiple HSN for same ledger account at Transaction levels:

Let’s take an example of Interest to be charged for delayed payment for which E-invoice is generated. The HSN Code has to be as per the Item HSN of the transaction for which Payment is delayed. There cannot be multiple ledger accounts for each type of item for which delayed payment is charged. To ensure smooth working in this we can use “GST Classification”

The steps to achieve the above is: Activate GST Classification in F11 >> GST details – Set the same Yes, then from Gateway of Tally >>Create GST Classification. – Do create as per the HSN Code required.

While posting the transaction while you have selected Interest Ledger, ensure you are able to select GST Tax Rate Details after selection of credit ledger (If not visible, then enable – Show GST Classification from F12 config option) which can help you to select the GST Classification as mentioned in the above steps.

To list out all common errors one may also refer https://help.tallysolutions.com/tally-prime/gst-regular-sales/e-invoice-faq/

About the author

Similar reads

Managing banking and accounting separately can slow you down in today’s fast-paced business world. Switching between bank portals, manually uploading statements, and reconciling transactions takes

Read More

Nowadays, business agility is essential for success in the market, rather than just being a buzzword. Businesses looking to scale, change direction, or pivot in the cloud must adapt to online

Read More

TallyPrime on AWS is a cloud accounting solution that offers businesses the flexibility to work on the same data from multiple devices and locations collaboratively. For example, imagine you are

Read More

With TallyPrime 5.0 release, we have introduced and enhanced feature: Stripe View. Let's dive into how this enhancement is set to revolutionize your data visualization experience.

Read More

TallyPrime 5.0 connected GST return filing experience will prove to be a game-changer for businesses. With seamless uploads, downloads, auto-reconciliations, and return filing, TallyPrime has now tran

Read More