SHARE

| Mar-23-2021

GST Charcha on Union Budget 2021: Changes in Scope of Zero-Rated Supplies

GST Charcha on Union Budget 2021

Changes in scope of zero-rated supplies

The Hon’ble Finance Minister, in Budget 2021-22, hailed as a ‘development-oriented’ and ‘visionary’ budget amid the pandemic-induced disruptions, inter alia, announced multiple changes to the Goods and Services Tax (“GST”) framework. The changes have been proposed vide the Finance Bill, 2021, that amends the Central Goods and Services Tax Act, 2017 (“CGST Act”) and the Integrated Goods and Services Tax Act, 2017 (“IGST Act”), in order to ease doing of business, curb input credit frauds, safeguard Government revenues and to provide statutory backing to debated Rules.

This GST Charcha deciphers into recent changes in GST Laws made vide Clause No. 114 of the Finance Bill, 2021 to with respect to changes in scope of zero-rated supplies.

Relevant provision:

Words ‘for authorised operations’ are proposed to be inserted in Section 16(1)(b) of the IGST Act:

“16. Zero rated supply:

(1) “zero rated supply” means any of the following supplies of goods or services or both, namely:––

(b) Supply of goods or services or both for authorised operations to a Special Economic Zone developer or a Special Economic Zone unit.”

Sub-section (3) of Section 16 of the IGST Act is proposed to be substituted:

“16. Zero rated supply:

(3) A registered person making zero rated supply shall be eligible to claim refund of unutilised input tax credit on supply of goods or services or both, without payment of integrated tax, under bond or Letter of Undertaking, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder, subject to such conditions, safeguards and procedure as may be prescribed:

Provided that the registered person making zero rated supply of goods shall, in case of non-realisation of sale proceeds, be liable to deposit the refund so received under this sub-section along with the applicable interest under section 50 of the Central Goods and Services Tax Act within thirty days after the expiry of the time limit prescribed under the Foreign Exchange Management Act, 1999 for receipt of foreign exchange remittances, in such manner as may be prescribed.

(4) The Government may, on the recommendation of the Council, and subject to such conditions, safeguards and procedures, by notification, specify–

(i) a class of persons who may make zero rated supply on payment of integrated tax and claim refund of the tax so paid;

(ii) a class of goods or services which may be exported on payment of integrated tax and the supplier of such goods or services may claim the refund of tax so paid.”

Discussion and Comments:

Changes in scope of zero-rated supplies

Section 16 of the IGST Act is proposed to be amended to bring the following changes:

- SEZ supplies to be used only for authorised operations – Under Section 16(1)(b) of the IGST Act, it is proposed that the benefit of zero-rated supply made to a SEZ unit or SEZ developer will be allowed only when the same is for authorised operations.

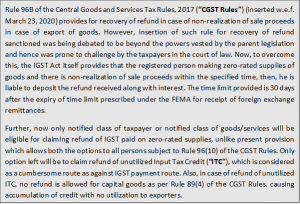

- Zero-rated supply under IGST route restricted to only notified categories – Section 16(3) of the IGST Act has been amended with insertion of new Section 16(4) in a manner that it restricts the option of zero-rated supply on payment of integrated tax (IGST) only to a notified class of taxpayers or notified supplies of goods or services;

- Non-realization of sales proceeds of goods exported will require depositing refund amount with interest– A proviso to Section 16(3) of the IGST Act is proposed to be inserted requiring the registered person making zero-rated supply of goods, in case of non-realization of sale proceeds, to deposit the refund amount along with interest, within 30 days after the expiry of the time limit prescribed under the Foreign Exchange Management Act, 1999 for receipt of foreign exchange remittances.

Note: Amendments carried out in the Finance Bill, 2021 will come into effect from the date when the same will be notified and when the said clause also gets concurrently notified with the corresponding amendments passed by the respective States and Union territories in respective SGST/ UTGST Act.

DISCLAIMER: The views expressed are strictly of the author and A2Z Taxcorp LLP. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon.

Similar reads

The Hon’ble Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, while presenting the Interim Budget 2024-25 in Parliament today asserted that by unifying the highly fragmented i

Read More

The Goods and Services Tax Network (GSTN) ushers in a transformative update to the GSTR-1 return, unveiling two pivotal tables – Table 14 and Table 15.

Read More

The latest release of TallyPrime is loaded with key features such as GST reconciliation ( GSTR-2A, GSTR-2B, and GSTR-1), multi-GSTIN support in a single company, powerful report filters, and..........

Read More

Key Recommendations of the 52nd GST Council Meeting: All You Need To Know 📌 A. Recommendations relating to GST rates on goods and services: 📢 I. Changes in GST rates of goods: ➡️ GST rates for "F

Read More

NIC has published the following error codes, error message, the reasons for the errors and the corresponding resolutions to help you resolve errors faced during e-Invoice upload to the NIC portal.

Read More