SHARE

| Jan-04-2024

5 New Capabilities of TallyPrime that Simplifies GST Compliance for Your Business

TallyPrime Release 3.0 comes with newer and more powerful capabilities and enhancements in the entire GST lifecycle from set-up, invoicing, returns, and reconciliation to help you manage your GST compliance needs with greater ease and greater speed.

The latest release of TallyPrime is loaded with key features such as GST reconciliation (GSTR-2A, GSTR-2B, and GSTR-1), multi-GSTIN support in a single company, powerful report filters, and integration with payment gateways. Not just these. There is more.

TallyPrime release 3.0 is built to bring in more features that simplify your GST and business needs.

Let’s look at 5 new capabilities that come with Release 3.0.

| TallyPrime's GST Reconciliation – A seamless way to reconcile GSTR 2A & 2B | Got Multi-GSTIN? How TallyPrime Can Help You Manage Multi-GSTIN In A Single Company? |

5 New Capabilities of TallyPrime

1. Instant GST returns

Instant, single-key reporting is one of the unique experiences with TallyPrime. We have been doing this for ages for all business reports, such as Balance sheets, P&L accounts, etc. With TallyPrime release 3.0, You will have the same delightful experience when generating your GST returns.

No matter what your data size is, the GST return report will open instantly. Thus, helping you save precious time in your compliance activities. No more waiting only smiles.

2. GST Return Sign

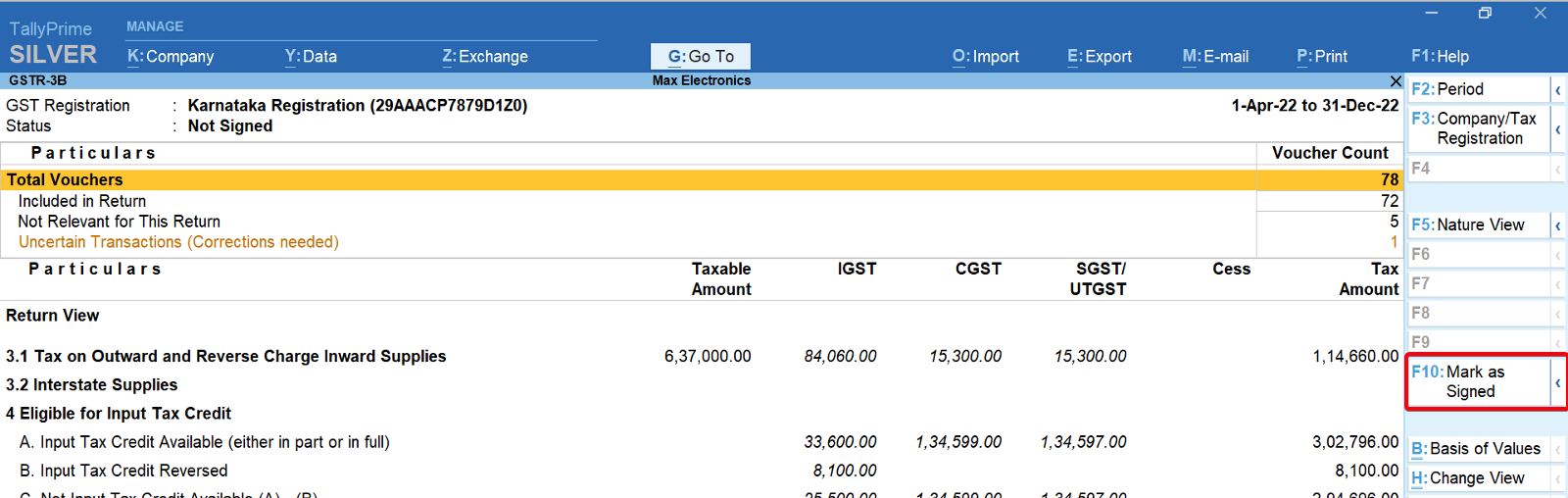

Release 3.0, the latest release of TallyPrime, introduces a new feature that allows you to sign the return. After submitting the returns in the GST portal, you can mark the return report in TallyPrime as ‘Signed’, indicating that the return for a specific period is verified and filed in the portal.

After making the returns as signed, any modification in transactions, including new additions pertaining to the return period, will be identified and highlighted for your action. This way, it becomes easy for you to track the changes and report them as amendments in subsequent returns.

3. Amendments and Reporting in Returns

We all know that returns cannot be revised once the GST returns are filed and the tax is remitted. Also, there is no concept of filing revised returns. However, there will be instances that require you to make changes in transactions pertaining to the period for which the returns are already filed.

For example, there is an error in the amount field or the total amount of the invoice, and you would want to revise the transaction after the returns are filed. While the returns already filed can’t be modified, the GST portal allows you to report all such revisions in subsequent returns as amendments.

With the latest release TallyPrime, you can easily manage the complete cycle of amendments and reporting in return. As a practice, all you need to do is once the returns are filed in the GST portal, you need to mark the returns as ‘signed’. After the returns are signed, all modifications, including the new additions, are identified and tracked for your action.

For example, you have recorded an invoice for April 2023, and the return and payment are made on 15th May 2023. On 25th May, you noticed an error in the tax amount and wanted to modify the transaction. You can manage this by simply following the below steps:

- Mark the return as signed in TallyPrime when returns are filed in the portal

- Now that returns are signed, any modification pertaining to the return period will be tracked

- Modify the April transaction and mention the correct tax amount.

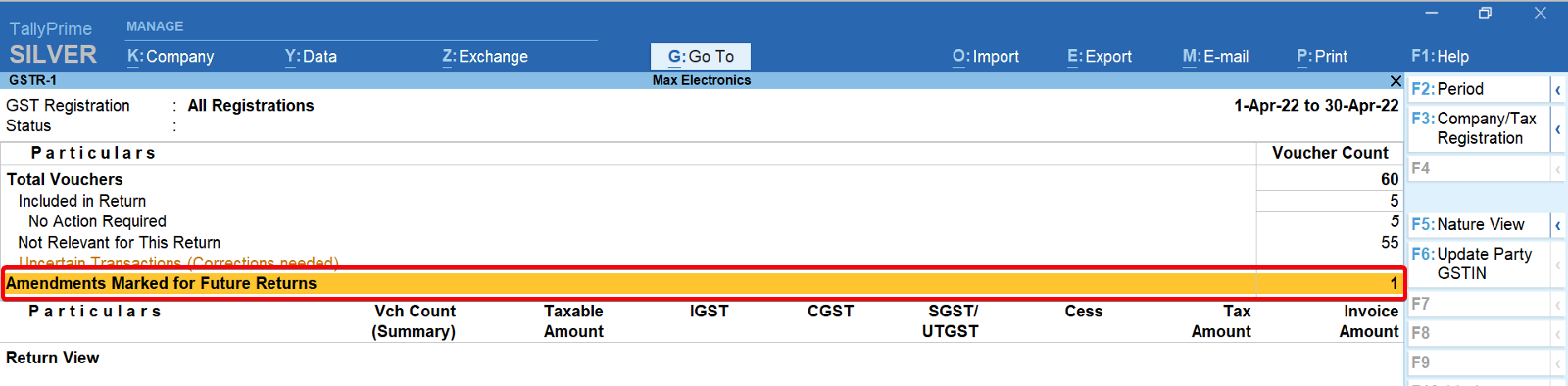

- TallyPrime will automatically identify and report all such modifications under the ‘Uncertain Transactions’ section in GSTR-1

- Next, select the transaction and mention the ‘Return effective date’. The return effective date refers to the return period date when such modifications need to be reported. In the above case, mention the return effective date as 25th May

- Now, the modifications will be automatically reported under the ‘Amendments’ section of May GSTR-1. Also, TallyPrime will report the difference amount due to the amendment in GSTR-3B of May’23

4. Track GST Return Activities

So many returns to be filed, so many return periods, and so many registrations. How do you keep track of them all? Don't worry! Release 3.0, the latest release of TallyPrime, makes it simple to track the status of all return tasks and activities at the click of a button. This is made possible with a new GST report, ‘Track GST Return Activities,’ which gives you a quick summary of pending activities for all your returns across return periods and GST registrations, all in one place.

You easily get to know If returns are exported, reconciled, the ones that are pending to be signed, and much more. The best part is that you can drill from this report to the respective return and perform the desired action.

What's more, you have the flexibility to customise the Track GST Return Activities report in several ways. For example, you can change the report from a return-wise view to a period-wise view, or you can view the report to see only pending or for your completed activities.

5. Simpler, more flexible, and intuitive configurations

The latest release of TallyPrime comes with a more powerful and flexible GST configuration experience which will not only help you manage exceptional situations with ease but also stay compliant always. Here few new configurations are enhanced in TallyPrime release 3.0:

- Option to mark Registration status as ‘Active/Inactive.’

- Flexible to manage switchover from composition scheme to regular or visa-versa by just mentioning the effective date of such changes. TallyPrime will take care the all the complexities, from invoicing to returns.

- The new simplified GST rate set-up makes configuring the GST details for stock groups, items, and ledgers easy. No matter whether you want to configure or change for one stock item or multiple items, TallyPrime makes it easy to configure and quick to identify the details already configured

- Create and assign multiple voucher series for a single voucher type.

- GST calculation support in ‘Material in’ and ‘Material out’ voucher types to help you save more time.

There is more…

Apart from the above-mentioned features, TallyPrime 3.0, is packed with numerous more features to manage your compliance and business needs.

- GSTR-2B and GSTR-2A reconciliation

- Multiple GSTIN support in a single company

- All new powerful report filter

- Flexible voucher numbering and voucher series

- Integration with payment gateways

Videos to check out

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

Simplified & Powerful Report Filters | TallyPrime Walkthrough

Payment Gateway Integration | TallyPrime Walkthrough

How to Use Multiple GST Registrations Feature in TallyPrime

Voucher Numbering Behaviour in TallyPrime

Similar reads

The Hon’ble Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, while presenting the Interim Budget 2024-25 in Parliament today asserted that by unifying the highly fragmented i

Read More

The Goods and Services Tax Network (GSTN) ushers in a transformative update to the GSTR-1 return, unveiling two pivotal tables – Table 14 and Table 15.

Read More

Key Recommendations of the 52nd GST Council Meeting: All You Need To Know 📌 A. Recommendations relating to GST rates on goods and services: 📢 I. Changes in GST rates of goods: ➡️ GST rates for "F

Read More

NIC has published the following error codes, error message, the reasons for the errors and the corresponding resolutions to help you resolve errors faced during e-Invoice upload to the NIC portal.

Read More

Register TallyPrime for Tally GSP Service only in case your business need E-invoice or not registered E-way bill Online Service in TallyPrime.

Read More